Individual Investors

Wealth means different things to different people, but for most of us, true wealth is more than just money. True wealth can often be defined by people, passion and purpose.

Wealth means different things to different people, but for most of us, true wealth is more than just money. True wealth can often be defined by people, passion and purpose.

MGO Signature

At MGO, we understand that the definition of true wealth must include people, passion and purpose.

At MGO, we understand that the definition of true wealth must include people, passion and purpose.

PEOPLE – life is about relationships – which ones are important to you and how are you investing in them?

PASSION – if you could do anything, what would you do?

PURPOSE – why are you here? What were you created to do?

PEOPLE – life is about relationships – which ones are important to you and how are you investing in them?

PASSION – if you could do anything, what would you do?

PURPOSE – why are you here? What were you created to do?

PEOPLE

life is about relationships, which ones are important to you and how are you investing in them?

PASSION

if you could do anything, what would you do?

PURPOSE

why are you here? What were you created to do?

PEOPLE

life is about relationships, which ones are important to you and how are you investing in them?

PASSION

if you could do anything, what would you do?

PURPOSE

why are you here? What were you created to do?

If you can answer these questions and define what’s most important to you, you’ll be able to identify and set goals and build a comprehensive plan to reach them.

We believe that wealth management is much more than just managing your money. That’s why we created MGO Signature.

MGO Signature is a wealth management process designed to help you identify your goals – what you really want to accomplish in life – and then develop and implement a financial plan to support your achievement of these goals.

If you can answer these questions and define what’s most important to you, you’ll be able to identify and set goals and build a comprehensive plan to reach them.

We believe that wealth management is much more than just managing your money. That’s why we created MGO Signature.

MGO Signature is a wealth management process designed to help you identify your goals – what you really want to accomplish in life – and then develop and implement a financial plan to support your achievement of these goals.

The MGO Signature Process

- Introductory Meeting

- Discovery Meeting

- Investment Plan Presentation

- Commitment Meeting

- 45 Day Follow-up

The MGO Signature Process is Ongoing

- Periodic Progress Meetings

- Advisory Team Meetings

What to Expect in Your Discovery Meeting

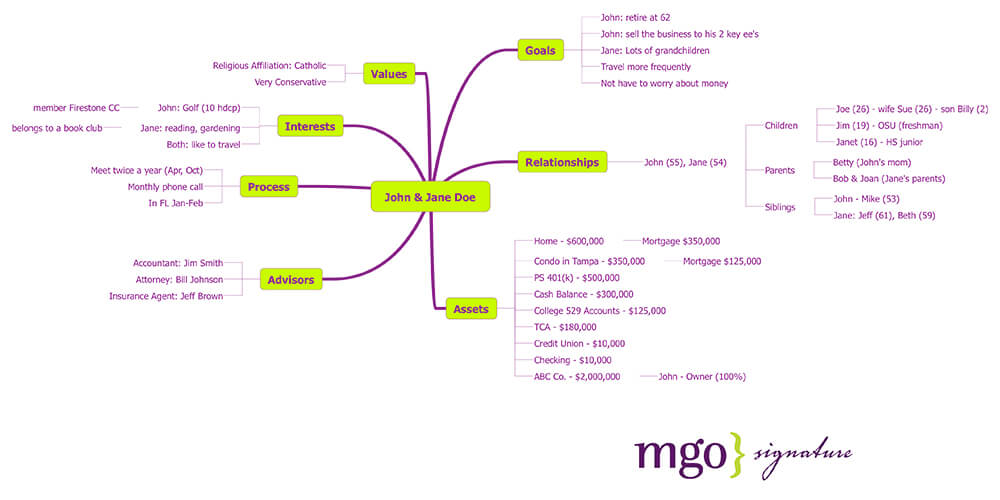

Successful wealth management begins with a comprehensive knowledge of the client. Each person’s situation has its own set of nuances, challenges and successes. MGO collects this information to get a clear picture of each client, to build wealth in a way that is exclusive to his or her individual situation.

Through a set of more than 60 questions, along with collecting pertinent account statements and documents, we will explore the following:

Successful wealth management begins with a comprehensive knowledge of the client. Each person’s situation has its own set of nuances, challenges and successes. MGO collects this information to get a clear picture of each client, to build wealth in a way that is exclusive to his or her individual situation.

Through a set of more than 60 questions, along with collecting pertinent account statements and documents, we will explore the following:

VALUES

What is important to you?

GOALS

What do you want to achieve and by when?

RELATIONSHIPS

Who is important to you and why?

(Family, friends, co-workers, pets)

ASSETS

What do you currently own?

ADVISORS

Who are the professionals (accountant, attorney, etc.) who advise you?

PROCESSES

How would you like to see things work?

INTERESTS

What do you like to do?

What is important to you?

What do you want to achieve and by when?

Who is important to you and why?

(Family, friends, co-workers, pets)

What do you currently own?

Who are the professionals (accountant, attorney, etc.) who advise you?

How would you like to see things work?

What do you like to do?

VALUES

What is important to you?

GOALS

What do you want to achieve and by when?

RELATIONSHIPS

Who is important to you and why? (Family, friends, co-workers, pets)

ASSETS

What do you currently own?

ADVISORS

Who are the professionals (accountant, attorney, etc.) who advise you?

PROCESSES

How would you like to see things work?

INTERESTS

What do you like to do?

VALUES

What is important to you?

GOALS

What do you want to achieve and by when?

RELATIONSHIPS

Who is important to you and why? (Family, friends, co-workers, pets)

ASSETS

What do you currently own?

ADVISORS

Who are the professionals (accountant, attorney, etc.) who advise you?

PROCESSES

How would you like to see things work?

INTERESTS

What do you like to do?

Your answers to these questions will help us to create a profile of what’s important to you – allowing us to create a Wealth Management Plan to help you reach your goals.

Your answers to these questions will help us to create a profile of what’s important to you – allowing us to create a Wealth Management Plan to help you reach your goals.

Your Investment Plan Presentation

Your investment plan will contain the following:

Current Analysis – We’ll perform a thorough analysis of your current investment portfolio.

Portfolio Enrichment – Based on your current allocations, market conditions and the analysis of your monetary needs to meet long term goals, we’ll present our detailed recommendations to build a portfolio designed to help you meet those goals.

Will I Have Enough?– That’s the question everyone asks. Our presentation will include accumulation projections to estimate how much you’ll have at retirement. Based on your stated goals, we will also include retirement income projections to show you know how long your money is likely to last under a variety of assumptions.

Your take-away from this presentation will be a clear picture of whether you are on track to have enough money for the retirement of your dreams. We’ll also let you know what steps you should take now to ensure your goals are met.

Your investment plan will contain the following:

Current Analysis – We’ll perform a thorough analysis of your current investment portfolio.

Portfolio Enrichment – Based on your current allocations, market conditions and the analysis of your monetary needs to meet long term goals, we’ll present our detailed recommendations to build a portfolio designed to help you meet those goals.

Will I Have Enough?– That’s the question everyone asks. Our presentation will include accumulation projections to estimate how much you’ll have at retirement. Based on your stated goals, we will also include retirement income projections to show you know how long your money is likely to last under a variety of assumptions.

Your take-away from this presentation will be a clear picture of whether you are on track to have enough money for the retirement of your dreams. We’ll also let you know what steps you should take now to ensure your goals are met.