Since 1939

About Us

About Us

At MGO, We Design and Manage Retirement Plans and Personal Investment Strategies.

Whether we are counseling business owners, retirement plan sponsors, plan participants or individual investors, we emphasize an approach that begins by learning your financial goals. We craft strategies and provide advice designed to focus on you as a person. Do you want to retire comfortably? Are you looking to manage your retirement nest egg? Do you want to maximize the dollars you are able to invest? These are all questions we help each of our clients answer.

Why so much focus on the individual? Because we believe that the definition of wealth is different for every person. Keeping your goals in mind, we advise individuals on how to balance tolerance for risk with their investment timeline. From the 40+ years of saving for retirement to managing your money in retirement, we have become lifelong advisors to plan sponsors, participants, and individual investors alike.

Firm History

We Are Built to Help Small Businesses, Owners, and Employees “Win” Retirement.

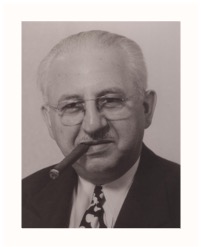

MGO’s roots date back to 1939, with the founding of Eugene M. Klein and Co., one of the first companies to offer retirement plans in the country. Over the course of the next 50 years, Klein’s company flourished, gaining a reputation for high-quality retirement plan design and maintenance.

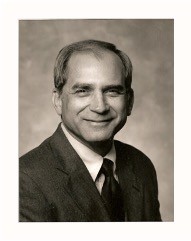

In 1968, financial industry pioneer Jack Moskal, established Capital Planning Corp., which focused on designing and managing investment portfolios for both retirement plans and individual and corporate investors. Emphasizing strategy and planning, Capital Planning Corp. was one of the first firms to coin the term ‘financial planner.”

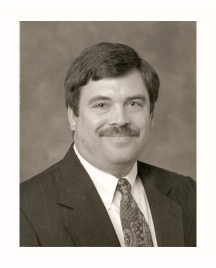

In 1990, the two firms came together to form Moskal Klein. The firm became Moskal Gross Orchosky, Inc. in 2003 to reflect the then current owners: Ronald S. Gross, Michael B. Moskal and Paul J. Orchosky. In 2022. CEO Ron Gross merged MGO under OneSeven, strengthening the firm’s growth and expanding its capabilities to better serve our clients.

Our Brand's Promise:

With every interaction, we want our customers to say, “Wow, I am glad I do business with them!”

Our Vision Statement:

Helping improve lives through retirement plans and personal investments.

MGO Timeline

Eugene M. Klein & Co., Inc. was founded by Eugene M. Klein

Jack Moskal founded J.D. Moskal & Assoc., which soon after became Moskal Jaras & Assoc.

Willard Weiss takes over Eugene M. Klein & Co.

Jack Moskal establishes Capital Planning Corp., one of the first to coin term ‘financial planner’

Willard Weiss sold Eugene M. Klein & Co. to a group including Richard Weiss, Willard’s son

E.M. Klein installed our first 401(k) plan

Paul Orchosky joined E.M. Klein & Co.

Michael Moskal joined Moskal Jaras & Assoc.

Ron Gross joined Moskal Jaras & Assoc.

Eugene M. Klein & Co., Inc. merged with Moskal Jaras & Assoc. creating Moskal Klein, Inc.

Ted Triska joined Moskal Klein, Inc.

Lisa Petersn joined Moskal Klein, Inc.

Moskal Klein, Inc., rolls out the Total Solution Retirement Plan

Assets under management reach $100,000,000

Assets under management reach $250,000,000

MGO rolled out the Road to Wealth personal investment program

MGO rolled out the Road to Retirement managed account program

Michael Gross joins MGO

MGO Road to Retirement program reaches $100,000,000 in assets

Justin Pietrasz joins MGO

Assets under management reach $500,000,000

Assets under management reach $1,000,000,000

Parker Kaesgen joins MGO

Brad Wingler joins MGO

MGO merged under OneSeven, strengthening the firm’s frowth and expaning its capabilites to better serve clients

John Conry joins MGO