Businesses &

Plan Sponsors

Plan Sponsors

When it comes to designing your company’s retirement plan our goal is simple; design a retirement plan that works. That means a plan or combination of plans that maximizes the opportunity for savings – for the business, the owners, key executives and the employees.

Total Solution Retirement Plan

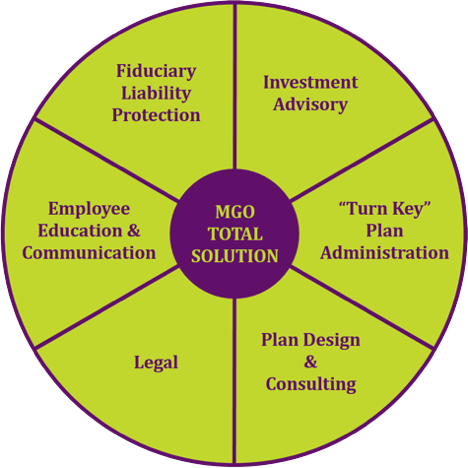

Retirement plans can be complicated and confusing. Our Total Solution concept simplifies our clients’ lives because with Total Solution, MGO handles ALL facets of the retirement plan. With MGO you don’t have to work with multiple entities like a separate investment advisor, record keeper and third party administrator. There’s no practical reason to separate all these functions and then spend the extra time and money required to keep everyone on the same page. With MGO it’s clear where plan responsibilities lie, with us. To begin with, you’ll have only one number to call to manage all aspects of your retirement plan, from investment advisory to fiduciary concerns, from administrative functions to employee education.

But we go one step further. MGO also takes ownership of much of the plan’s administrative work. We monitor deposit of withholding, enroll your participants, administer 401(k) loans and handle distributions for terminated participants. By taking on the administrative work for you, you and your employees are free to focus on your business and not your retirement plan. MGO’s Total Solution services include:

Best of all, our Total Solution services are tailored to fit your needs. Annually, we’ll re-assess not only plan design but also your service mix, matching new or different levels of service and plan features to your current needs, challenges and opportunities.