For Individual investors

Your Investment Plan Presentation

Your Financial Freedom Plan

Your plan will be a clear picture of whether you are on track to have enough money for the retirement of your dreams.

- Your investment plan will contain the following:

- Current Analysis: We’ll perform a thorough analysis of your current investment portfolio.

- Portfolio Enrichment: Based on your current allocations, market conditions and the analysis of your monetary needs to meet long term goals, we’ll present our detailed recommendations to build a portfolio designed to help you meet those goals.

- Will I Have Enough?: That’s the question everyone asks. Our presentation will include accumulation projections to estimate how much you’ll have at retirement. Based on your stated goals, we will also include retirement income projections to show you know how long your money is likely to last under a variety of assumptions.

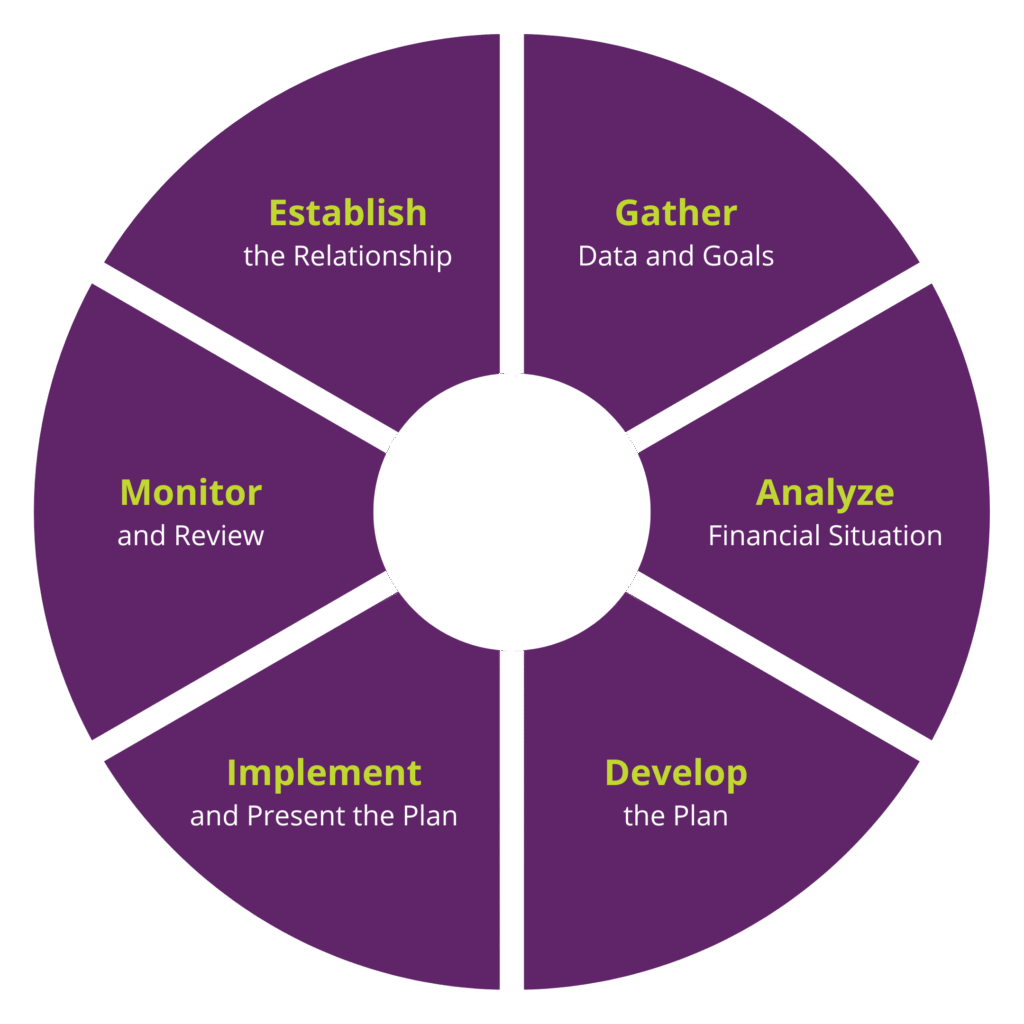

Financial Planning Process

1. Establishing the Relationship

- Define the scope of the engagement between the client and the financial advisor.

- Discuss services provided & responsibilities.

- Set expectations, communication preferences, and time frames.

2. Gathering Data and Goals

- Collect financial information

- Identify financial goals

3. Analyzing the Financial Situation

- Assess current financial position.

- Evaluate.

- Spot issues or opportunities.

4. Developing the Plan

- Create a customized strategy.

- Include recommendations and options that align with goals.

5. Presenting and Implementing the Plan

- Review the plan with the client.

- Make sure they understand the recommendations.

- Implement the agreed-upon steps

6. Monitoring and Reviewing the Plan

- Regularly review progress toward goals.

- Adjust the plan as needed.