Q2 Market Notes

THE STORY WAS INTEREST RATES

The story of the quarter was the story of interest rates and the U.S. Federal Reserve. In a little more than six months, the market has gone from expecting the Fed to lift rates to anticipating a minimum of one—and possibly as many as three—rate cuts this year.

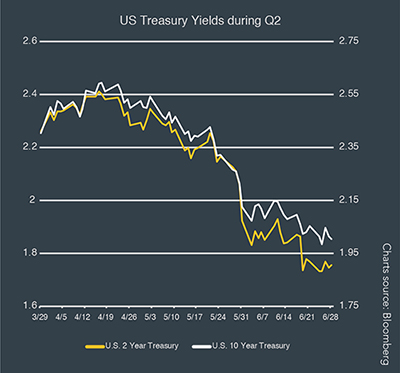

Much of the economic data was mixed throughout 2Q, not surprising given all the cross-winds. The quarter started on an up note, with the S&P 500 climbing more than 2% on positive news out of China and a strong U.S. jobs report. The major issues that have continued to bedevil global markets – China trade and Brexit – were around then, too, but there was a higher level of optimism that something would be resolved, at least with China. The yield on the 2-year Treasury stood at 2.33% on May 3; for the 10-year Treasury, that number was 2.53%.

EARNINGS BETTER THAN EXPECTED

Second quarter earnings were better than expected with many companies exceeding (previously lowered) analyst expectations. Unemployment reached a near 50-year low while wages demonstrated modest growth, providing support for the consumer to continue to spend. Towards the end of April, the S&P 500 was on course for the best four-month start to the year in more than three decades.

But, even as the markets were rising, data in the U.S. and elsewhere were starting to show some signs of weakness, suggesting that the failure to solve the China – U.S. trade conundrum was beginning to filter through to the real world. The month of May saw stocks retreat, with the S&P 500 down around 6% on the month. At the same time, 1Q GDP came in well above estimates, up 3.2% compared to expectations of around 2.3%.