Q1 Market Notes

The first quarter opened with global stock markets rallying. U.S. equities posted the strongest January returns in 30 years, as the S&P 500 climbed 7.9%. This was a continuation of the upturn that began just after Christmas when U.S. Federal Reserve Chairman Powell indicated that the Fed was unlikely to raise rates much if at all in 2019, a reversal from previous stated policy.

The positive trend held through the quarter, with the S&P 500 up 13%,getting back most of the losses from the end of 2018, and posting the best returns since 2009. European and Asian markets were positive as well for the period, with MSCI Europe climbing 11%. Hong Kong’s Hang Seng Index was a top performer as Chinese stocks continued to recover from a bruising 2018, up 12.58%.

In equities, growth topped value in the period, up 14.95% compared to 12.19%. Small cap, as represented by the Russell 2000, beat large cap climbing 14.58%. In fixed income, high-yield bonds led the way, recovering from a 4Q bloodbath to return 7.5%, followed by emerging market bonds, up 6.79%.Mortgages were up 2.17% and REITs just under 17%.

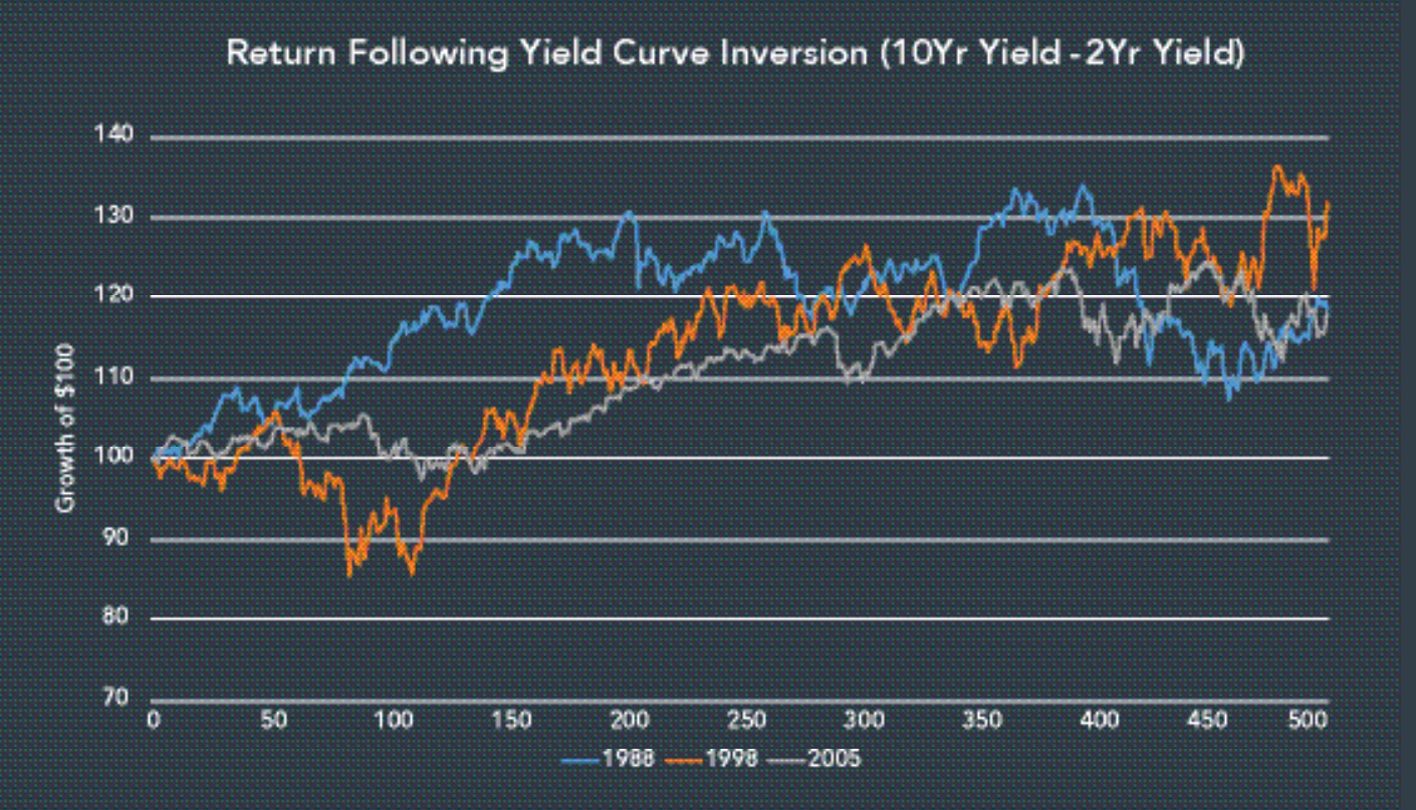

The yield curve inverted during the quarter as the yield on three-month Treasury bills exceeded that on 10-year Treasury bonds. This has often – but not always – been predictive of the start of a recession anywhere from 12-24 months out. Historically the curve inverted as the Fed raised rates at the short end and longer-term rates fell.This time around the Fed is already on hold with speculation that a rate cut may be coming later this year, creating a different dynamic.

What’s more, an inverted yield curve is not always bad for stocks. To cite one example: the S&P 500 was up 230% from 1994 to the end of the decade in the face of a yield curve inversion. So there are often other factors at work that can impact market performance.

To Read More