Q4 Market Notes

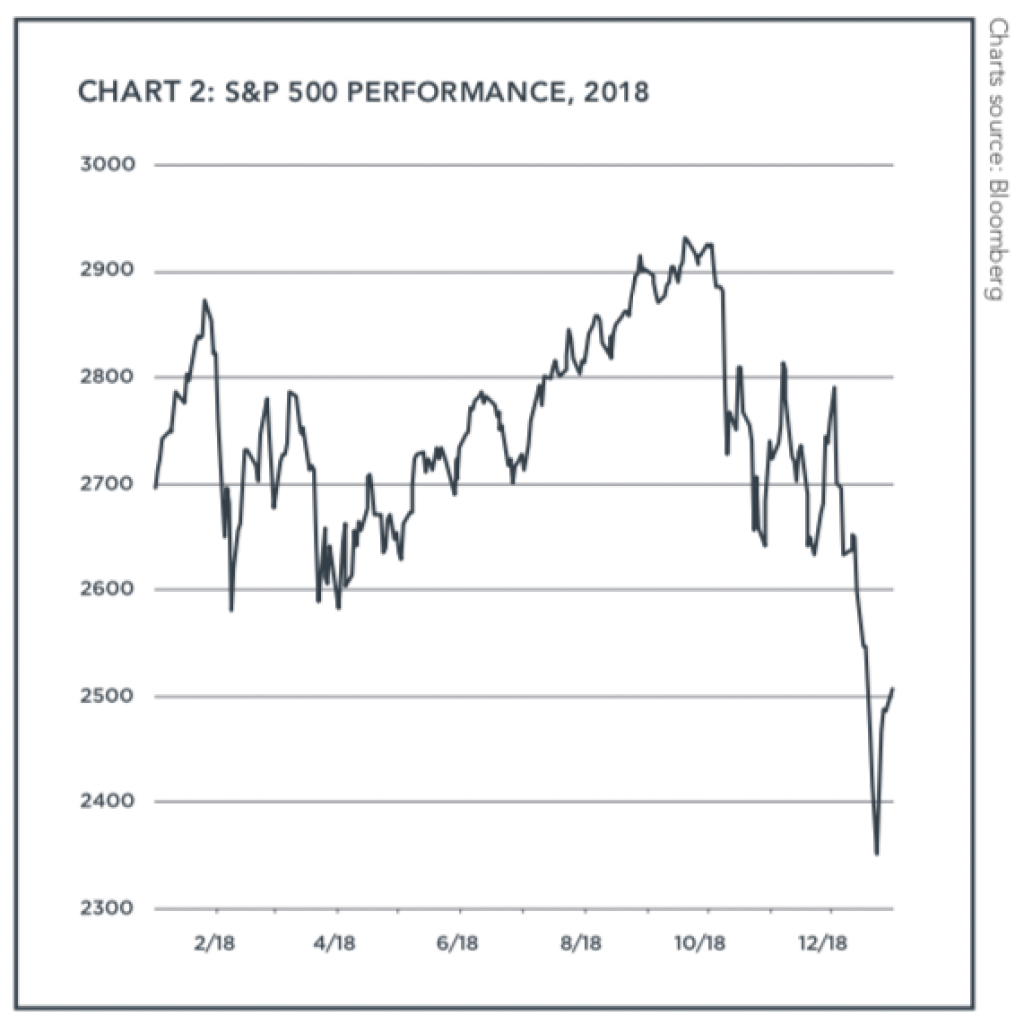

The fourth quarter of 2018 was decidedly different in many ways from the previous two quarters. U.S. stocks—which had generated strong performance for much of the year—plummeted during the fourth quarter, regardless of sector, investment style or market capitalization. Non-U.S. equities also were hit hard but managed to outperform the domestic market. In particular, emerging markets stock held up surprisingly well during a period of significant uncertainty and volatility.

Meanwhile, U.S. government debt—which had struggled throughout most of 2018—generated positive returns

as nervous investors flocked to “safe haven” assets in an effort to sidestep sizable losses in equities.

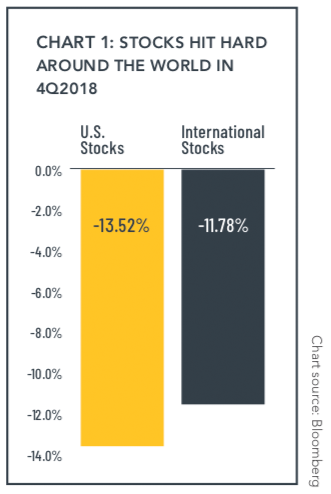

In aggregate, global stocks were down sharply during the fourth quarter:

- The S&P 500 index of large-cap U.S. stocks fell 13.52%.

- Broad-based developed-market international stocks (as measured by the S&P Global Ex-US BMI Index) returned -11.78%.

The market’s fall during the quarter was historic in at least one way: 2018 marked the first time ever in which the S&P 500 ended the year with a loss after being positive for the first three quarters of the year (see Chart 2).